Update Nov 11

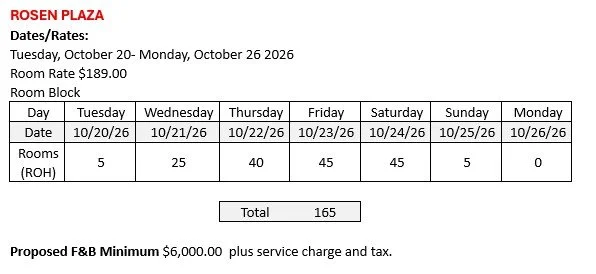

Good morning John, hope you’re having a good week. I have two proposals from the Rosen hotels, one from Plaza and one from Centre. Attached is Rosen Centre and below is Rosen Plaza. The Rosen group has always been military friendly and we’ve used them before. I’m still trying to get a proposal from Hilton Lake Buena Vista also. Unfortunately Rosen Centre does not have your preferred dates and can only offer dates in the range you said you wanted to avoid. So that may be off the table right away.

Concessions:

- (1) one-bedroom suite at group rate (4 nights max)

- (1) complimentary welcome amenity (hotel selection)

- 20% Attrition

- 1 per 40 complimentary room nights

- Group rate available 3 days pre/post, based on hotel availability

- Complimentary fitness center access

- Complimentary guestroom internet

- 25% Discounted self-parking for overnight guests

- No Resort Fee

- 20% off AV

- 20% off IT

- Meeting space internet for up to 5 WIFI connections

- Complimentary storage/handling for ten (10) boxes (up to 150lbs total)

- 25% discount on receiving/handling

- Twenty-one (21) day cut-off

- 20% Discounted breakfast buffet for Café Matisse

Here are links of our hotel:

Video of our hotel: Rosen Plaza

Menus: Rosen Plaza Catering Menus

Facilities Guide: Rosen Plaza Facilities Guide

Timing

November primary focus

Bob Doerr suggests: Oct 22-25 or Nov 19-22.

Details/Other

Galen Peterson is now part of the events team

Armed Forces Reunions, Inc https://www.armedforcesreunions.com/

Charley Dey